Sansone CPA & Financial

Wealth Management Designed With Your Taxes in Mind

-

Wealth Management

-

Tax Services

Integrated CPA & Wealth Management Firm Based in Crystal Lake, Illinois

Work with a financial advisor and CPA who coordinates your investment strategy and tax planning.

We coordinate tax planning and investment management so your financial decisions work together. Not against each other.

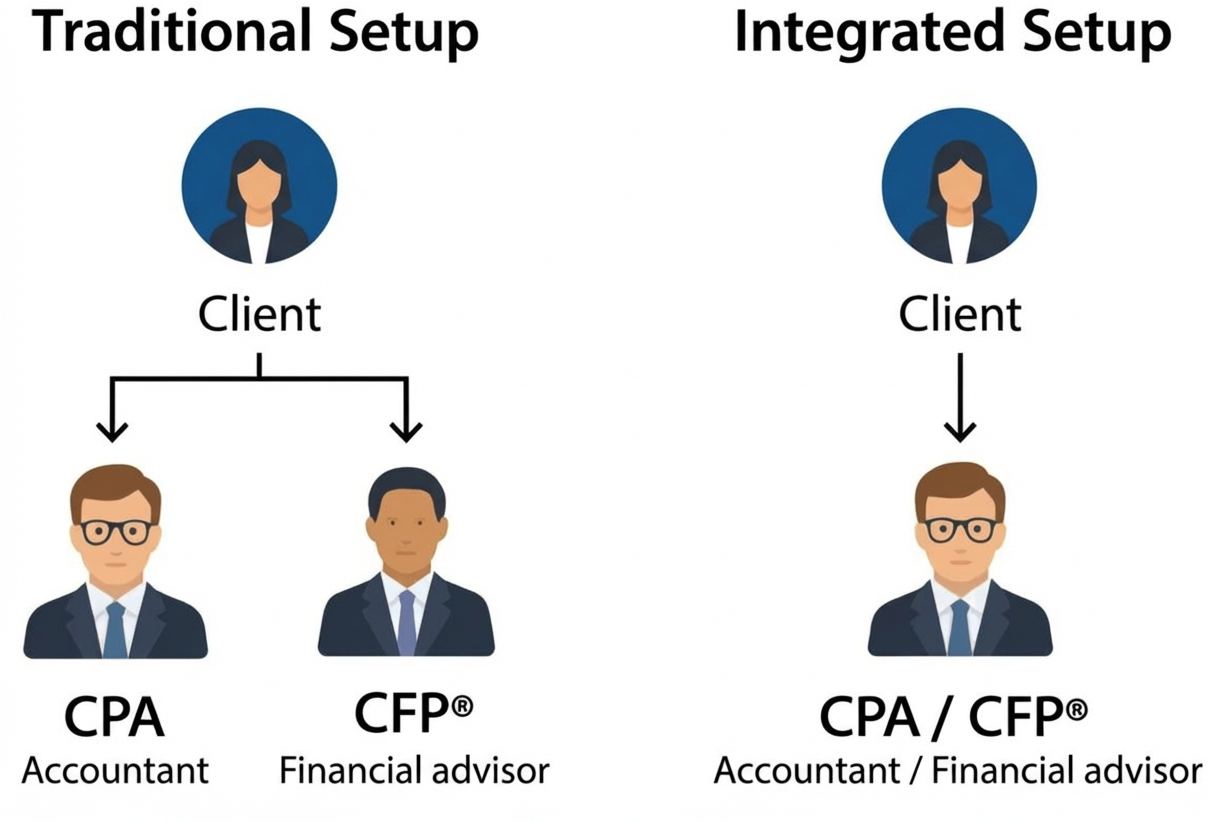

Most people receive financial advice in pieces.

• A CPA prepares the tax return

• An advisor manages your investments

• Decisions get made independently

Without coordination, planning opportunities are missed and unnecessary tax surprises can occur.

At Sansone CPA & Financial, tax planning and wealth strategy are aligned under one relationship.

Who We Serve

For Retirees & Pre-Retirees

Retirement income planning coordinated with proactive tax strategy.

We work with retirees who have accumulated substantial savings and want clarity around:

• Social Security timing

• Required minimum distributions

• Withdrawal sequencing

• Roth conversion analysis

• Coordinated investment management

Our focus is helping structure retirement income in a tax-efficient and predictable way.

For Business Owners (S-Corporations)

Strategic tax planning for established S-corporation owners generating between $500,000 and $5 million in annual revenue.

We help align:

• Business tax strategy

• Compensation planning

• Retirement contributions

• Investment management

• Business & personal tax planning

So decisions made in your business and personal finances support your long-term strategy.

One Firm. One Strategy.

Your portfolio rebalancing, retirement plan contributions, and how you handle your investment accounts all affect your tax situation. We align every move to help lower your tax bill, grow your wealth, and reduce tax surprises.

No guesswork. No handoffs.

If you're looking for a full-service, year-round partner for proactive tax and wealth management strategy, we can help.

Want to See What This Looks Like?

We offer a free consultation to review your situation, identify missed tax savings opportunities, and an overview of how to have a more tax efficient approach to your situation:

Call now

Services

Wealth Management and Investment Advisory.

Tax Preparation, Tax Planning, and Tax Projections.

HOURS:

Regular Hours

Monday-Friday: 8:00 AM – 4:30 PM

Tax Season

February 1st – April 15th

Monday – Friday: 8:00 AM – 6:00 PM

Saturday: 8:00 AM – 12:00 PM